The connection between Market Value and Realized Value is a metric used to analyze long-term cycles, identifying how much the market is profiting from the volume of crypto traded. This metric is used in the MVRV indicator.

The MVRV indicator was created by Murad Mahmudov and David Puell, right after the creation of the Realized Cap concept by the Coinmetrics team, guided by Nic Carter and Antoine Le Calvez.

But, before calculating the MVRV, we need to understand what Market Value and Realized Value are.

What is Market Value?

Also known as market capitalization, Market Value applies to Bitcoin by multiplying the BTC / USD pair's last trading price by the total number of Bitcoin mined so far.

In general, the higher the market value of a cryptocurrency, the more dominant it is in the market. For this reason, Market Value is considered one of the most important indicators for crypto assets classification.

What is Realized Value?

Realized Value represents the total acquisition cost of all Bitcoin in circulation on the market.

The Realized Value indicator eliminates lost coins from the calculation, showing the volume sum of long-term positions.

Let's say that you have 30 BTC in your wallet, deposited in three separate transactions:

- 10 Bitcoin purchased at USD 5,000.00

- 05 Bitcoin purchased at USD 15,000.00

- 15 Bitcoin purchased at USD 10,000.00

The realized value is found by calculating the acquisition price of all Bitcoin in your portfolio. In this case, the realized value is:

(10 x 5.000) + (5 x 15.000) + (15 x 10.000) = USD 275.000,00.

To obtain the average acquisition price of 30 BTC, divide the amount realized by the total number of Bitcoin: USD 275,000 / 30 BTC = USD 9,166.66.

In other words, you paid an average of USD 9,166.66 per Bitcoin.

Is that gain or loss?

It depends on the current price of Bitcoin. If it is lower than USD 9,166.66, it means that you have paid more than its current value. If it exceeds USD 9,166.66, it means that you are profiting on these operations.

Imagine that the current price of Bitcoin is around USD 20,000.00. These 30 BTC are now worth USD 600,000.00 in the market. If you sold them all, you would make a profit of $ 325,000 (USD 600,000 - USD 275,000).

We can now calculate this acquisition price across the Bitcoin network, giving us an estimate of the total amount of money users spent to buy their Bitcoin.

What is MVRV?

Market Value to Realized Value, better known as MVRV, is the relation between the market value of a crypto asset and its realized value. This relation is used to help identify market tops and bottoms, providing valuable information about the market's behavior.

One way to understand the MVRV indicator is to think of it as a behavioral comparison between speculators and holders. Assuming that sudden price changes are caused mainly by speculation, the Market Value is considered an indication of the point of view of speculators.

On the other hand, Realized Value shows market valuation from the point of view of holders, reflecting prices at entry time, and it is not so affected by sudden price fluctuations.

How to calculate the MVRV?

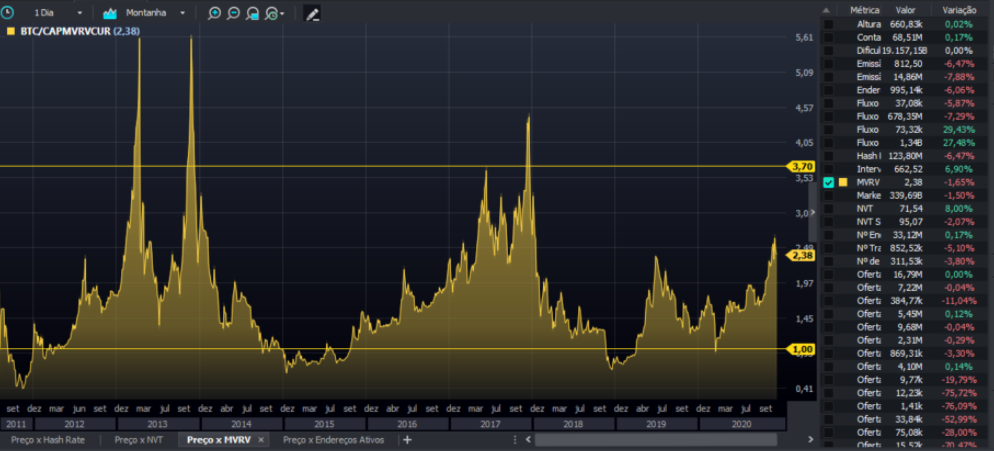

The MVRV is obtained by dividing the market value by the realized value. To use the indicator in your trading, two threshold values are given:

- Upper limit: 3.7. If the MVRV moves above this level, it indicates an overvaluation of Bitcoin.

- Lower limit: 1.0. If the MVRV moves below this level, it indicates an undervaluation of Bitcoin.

Consequently, MVRV of 1 is an important point:

- MVRV above 1: warns that speculators have a higher average market valuation than holders.

- MVRV below 1: signals that holders have a higher market valuation than speculators.

Historical data shows that holders are tested whenever the MVRV is below 1, where it's less likely they will be able to sell Bitcoin, indicating a potential accumulation cycle.

The importance of the MVRV indicator

MVRV has proven to be an excellent indicator of tops and bottoms, mainly for Bitcoin. The peaks in MVRV indicate that the market is at the top, while bottoms occur during accumulation intervals.

For Bitcoin, the MVRV shows relatively healthy growth patterns followed by brief intervals of accumulation. Above, the MVRV recovered three times above 1, providing long-term support from holders, which balanced speculation cycles.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!