When devising an investment strategy to achieve long-term financial goals, it is crucial to understand the correlation between Bitcoin's Market Cap and its potential risk and return. You will be better prepared to execute more balanced operations, knowing what is behind the valuation of digital assets.

Why is Market Cap so important?

Also known as market capitalization, Market Cap allows investors to consider the relative value of one cryptocurrency compared to others, analyzing its history of capitalization and projecting the movement of investors in the medium and long terms.

Several factors can impact the market value of crypto assets such as significant variations in price, the number of tokens in circulation, and how many are yet to be issued.

In addition, any financial asset may suffer price variations due to high market speculation and possible bubble formation.

Market Cap and investment strategies

Market capitalization is a metric used to identify assets with potential for appreciation, helping to create a diverse digital portfolio. In analogy with traditional financial markets, we will use the concepts of Small-cap, Mid-cap, and Large-cap to classify cryptocurrencies:

Small-cap

Low liquidity projects at the beginning of the roadmap are among the riskier options for long-term investment. Several ERC-20 tokens were issued during a wave of ICO (Initial Coin Offering) in 2017. They occupy the lowest positions in the market capitalization ranking. In the traditional market, Small-caps have between US$ 300 million and US$ 2 billion in market capitalization.

Mid-cap

Assets in this category of capitalization are already established but are still in the process of appreciation and market expansion. Being listed on the main cryptocurrency exchanges around the world, they count on a community of active developers with innovative whitepapers. Mid-cap projects are relatively riskier than those categorized as Large-caps but are more attractive than Small-caps since they already have real solutions and are more developed in the market.

In the traditional market, Mid-cap companies have up to US$ 10 billion in market capitalization.

Large-cap

Market capitalized cryptocurrencies that exceed billions of dollars have generally existed for a few years and are well-established players in the Blockchain landscape. Those who trade consolidated digital assets are usually expecting returns in the long term. They have acquired enough knowledge to analyze their own portfolios, using On-Chain data tools such as Hash Rate and MVRV, for example.

In the traditional market, Large-cap companies have over US$ 10 billion in market capitalization.

Market capitalization X Dollar price

The main difference between Bitcoin and traditional currencies is decentralization, with no country or banking institution controlling its network. In addition to the ease of having a Bitcoin wallet, Blockchain technology is completely transparent.

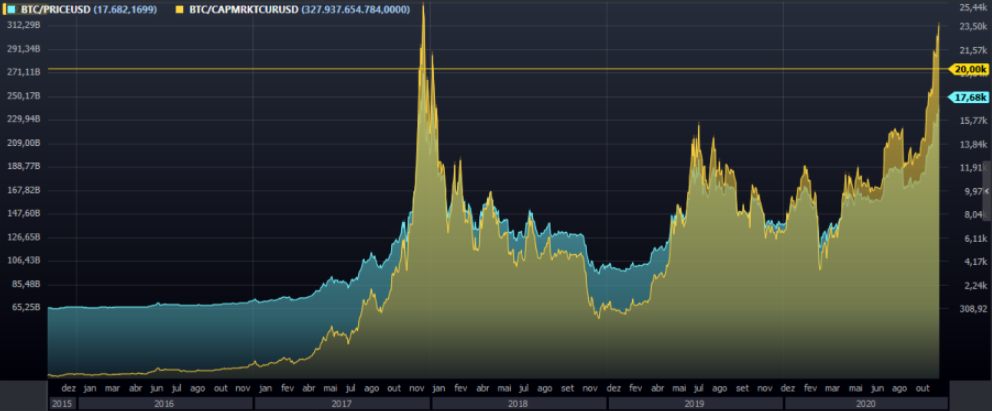

Market Cap X BTC/USD Price

Market Cap X BTC/USD Price

Since the creation of the BTC Price Index (average Bitcoin price listed on main global exchanges), these factors have contributed to a price increase from US$ 367 in January 2016 to over US$ 20K in December 2017, exceeding US$ 22K in 2020.

How to calculate the Bitcoin Market Cap?

To calculate the Bitcoin Market Cap, multiply the last trading price of BTC/USD by the total number of Bitcoins mined so far.

In general, the greater the capitalization of a cryptocurrency, the more dominant it is in the market. For this reason, Market Cap is considered one of the most important indicators used for classifying digital assets.

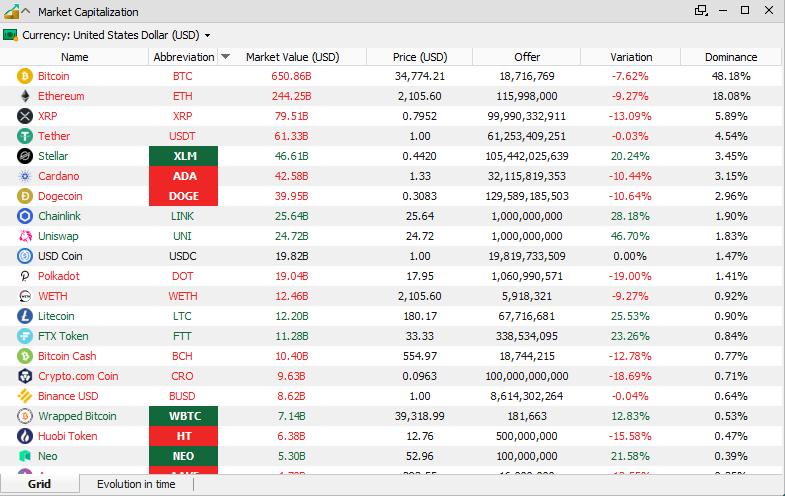

BTC price X Market Cap

BTC price X Market Cap

For example, if Bitcoin is trading at US$ 22,870.00 and has approximately 18.5 million tokens in circulation, then Bitcoin's market value is US$ 424 billion.

The Market Cap of companies like Apple, Disney, and Coca-Cola is often compared in the media to the market value of Bitcoin by economic analysts.

In December 2020, the portal Statista released the ranking of the 100 largest companies in the world by market capitalization, according to their Research Department, specialized in market data. If we put Bitcoin in that context, how would the market potential of the most famous cryptocurrency in the world rank?

The 10 largest companies in the world

To be specific, Market Cap is the value of a company based on the total value of its shares. Check out the companies with the highest market capitalization in 2020:

- Saudi Arabian Oil Company (Aramco) - US$ 1.68 trillion

- Microsoft - US$ 1.35 trillion

- Apple - US$ 1.28 trillion

- Amazon - US$ 1.23 trillion

- Alphabet - US$ 919 billion

- Facebook - US$ 583 billion

- Alibaba - US$ 545 billion

- Tencent Holdings - US$ 509 billion

- Berkshire Hathaway - US$ 455 billion

Bitcoin - US$ 424 billion - Johnson & Johnson - US$ 395 billion

The comparative value of assets is an important metric used to find opportunities in the market. Many stock exchanges like NYSE, and crypto exchanges like CoinMarketCap, disclose market capitalization data for listed assets.

Top 10 cryptocurrencies with highest market capitalization

The Vector platform's Market Capitalization tool provides refined data such as tokens' offers and market share percentages. Now, check out the 10 cryptocurrencies with the highest market capitalization:

Cryptocurrency market capitalization

- Bitcoin - US$ 424 billion

- Ethereum - US$ 69 billion

- XRP - US$ 23 billion

- Stellar - US$ 20 billion

- Chainlink - US$ 12 billion

- Litecoin - US$ 6.9 billion

- Binance Coin - US$ 6 billion

- Crypto.com Chain - US$ 5.9 billion

- Bitcoin Cash - US$ 5.9 billion

- Cardano - US$ 4.8 billion

In practice

Market capitalization corresponds to the expansion stage of a cryptocurrency. Investors who hold Large-cap digital assets in their portfolios are considered more conservative than those who favor Small-cap and Mid-cap alternatives, exchanging higher profits for potentially less risk.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!