Moving Averages can be very helpful and have been used for a long time by technical analysts. The main types of Moving Averages are Arithmetic (simple), Exponential, Weighted, and Welles Wilder.

In this article, we will cover Arithmetic and Exponential Moving Averages, considering they are the most utilized.

What is a Moving Average?

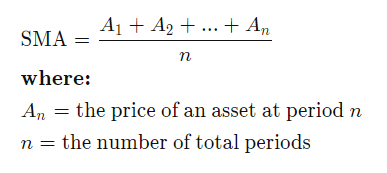

Considering the average value of a certain data sample, Arithmetic Moving Averages or Simple Moving Averages (AMA/SMA) represent the average value of closing prices over an interval of time.

In the formula above, V represents the different prices while N is the time window in which the average is built. The N parameter is important because it is the variable you need to adjust for the indicator to suit your setup. By adjusting its value, the Moving Average will respond more or less quickly to price changes.

Why is it called a Moving Average?

The word “moving” is used to convey dynamism. The Moving Average moves over the chart as earlier quotes stay behind, and new ones are added.

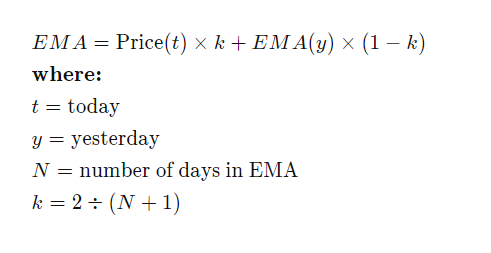

In the image below, we have the Exponential Moving Average (EMA) formula.

Price represents the current day’s closing and EMA yesterday is the previous value of the Exponential Moving Average. K is a variable that depends on the N interval:

Contrary to the Simple Moving Average, newer data have a higher importance in the EMA's calculation. Additionally, older values are not instantly discarded when outside of the calculation window, keeping a decreasing share in the value of the Exponential Moving Average.

There is also the Welles Wilder Moving Average. Not as widely known as the Arithmetic or the Exponential Moving Averages, but it can be a great option, as last prices have even more weight in its calculation.

What Moving Average should I use?

The main argument presented by some scholars is that the Simple Moving Average is too sensitive to market variations since its value is influenced by simultaneous inclusion and disposal of data. In an Exponential Moving Average, the influence of old prices diminishes over time, and more recent data have greater weight, better reflecting the current market mood.

Using a Moving Average

Moving Averages are part of a group of indicators called Trend Followers. These indicators have natural inertia and are not designed to show quick price reversals in advance. It's advisable to add Oscillators such as IFR and Stochastic to signal rapid changes.

The first important information provided by a Moving Average is its inclination. An ascending MA indicates a buying market, while a descending MA indicates a selling market.

Because Moving Averages are trend-following indicators, they are not ideal during market accumulation periods. Since there is no definite trend to follow, they can still be used at very short intervals, but might still send unclear signals.

Time Window Adaptation

As mentioned earlier, the Moving Average’s interval parameter needs to be adjusted. Since there are no clear rules on how to do that, like for most technical analysis tools, it is necessary to seek balance and to consider the selected asset and trade duration every time. This balance is important because:

- The longer the interval, the smoother and more immune to sudden movements the Moving Average will be. However, if the interval is too long, it may respond rather slowly to significant price changes.

- The shorter the interval, the more closely the Moving Average will follow the prices. However, if it's too short, the MA will be excessively exposed to price changes, thus becoming less useful as a trend-follower.

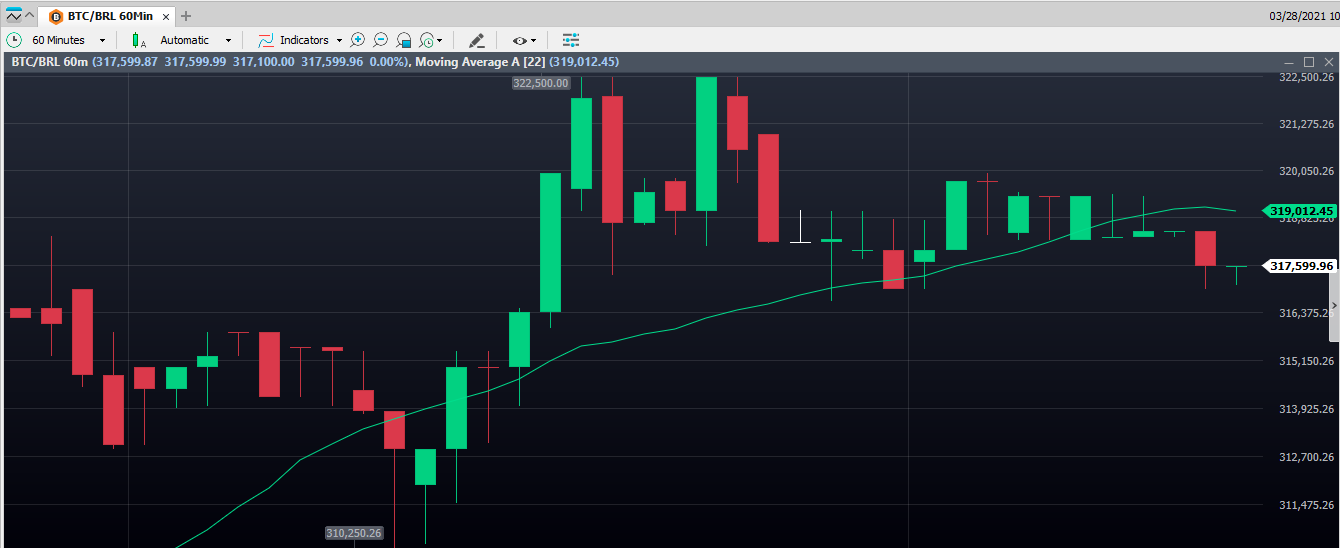

Example of a moving average (22 intervals)

Finally, how to define which average to use in operations? By practicing and using the trial and error technique. You can start, for example, with a interval of 22 (approximately the number of trading sessions in one month) or 30 for a daily chart. Diversify the value and observe if the indicator’s response is superior or inferior to the previous test.

Hey, Was this content helpful?

Please rate us below! It's important that we work together to make our Help Center even more complete!