Intent on improving volume-based indicators, market analyst Marc Chaikin developed the Chaikin Money Flow (CMF) as an expansion of the well-known On Balance Volume (OBV).

The CMF measures an asset's flow of financial volume within a given period, comparing the closing price with the difference between highs and lows of the interval to identify the prevalence of buying or selling pressure.

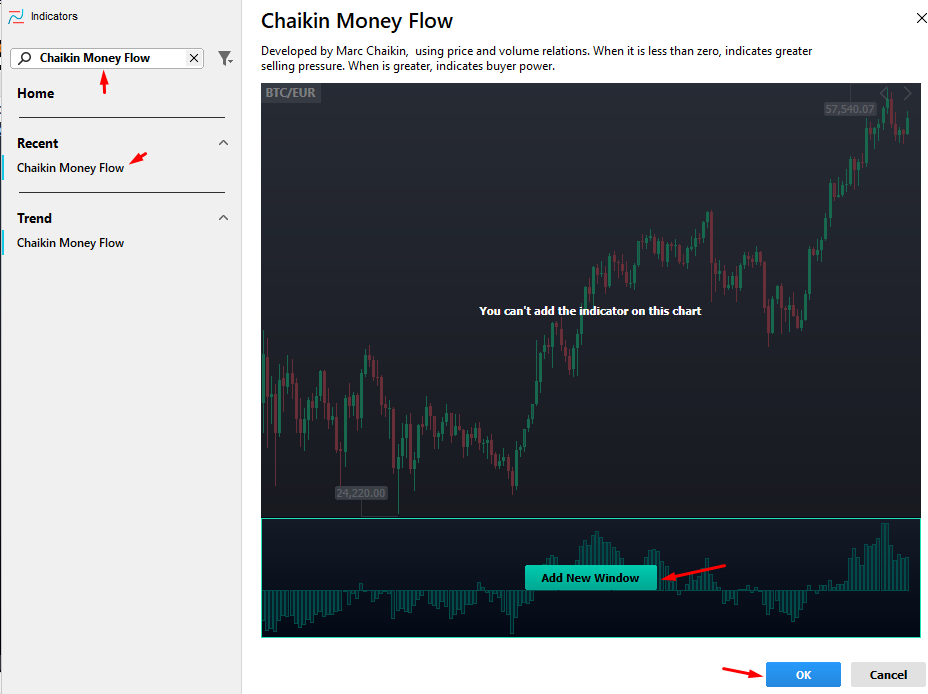

To add it to your desktop, access the Insert menu > Indicators > Chaikin Money Flow:

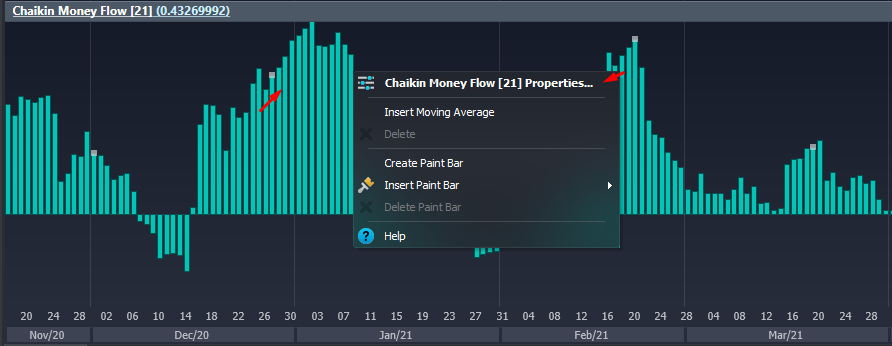

To modify appearance and parameters, right-click the indicator and select Properties:

Understanding the indicator

The reasoning behind the Chaikin Money Flow can be summarized as follows:

- If price closing is near the highs of the interval, with rising volume, the indicator's value will be positive.

- If price closing is near the lows of the interval, with rising volume, the indicator's value will be negative.

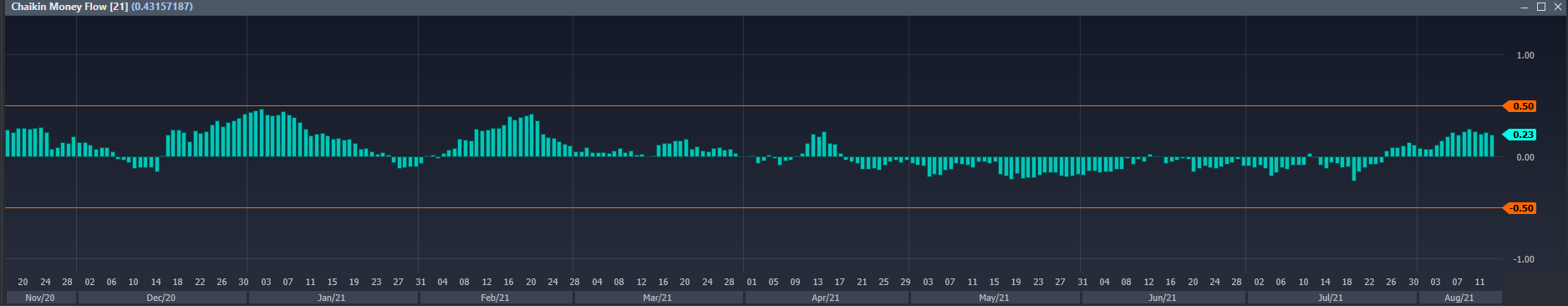

The CMF fluctuates between levels +1 and -1, however reaching these extremes is a rare event.

Interpretation

The first relevant information that the CMF provides to the analysis is whether buying or selling pressure is higher, also known as asset bias. Yet, enhanced applications of the technique can even generate objective entry and exit signals.

The zero line crossing is the main trading system applied to the Chaikin Money Flow:

- Buy signal: when the indicator crosses the zero line from bottom to top (positive).

- Sell signal: when the indicator crosses the zero line from top to bottom (negative).

The image below demonstrates convergences, or confirmations, between the price chart and the CMF's histogram. When the price reaches high and low regions for the period, indicated by the red arrows, the indicator crosses the zero line in the same direction, confirming the reversal or the beginning of a new trend.

The yellow arrows show confirmations of trend continuation when price finds support and resistance regions on chart:

Note

Chaikin Money Flow can be a great analysis tool. However, it is essential that the trader fully understands it and considers the signals within the current market context.

False signals most often occur during price congestion, where the indicator briefly crosses the zero line to the opposite side.

We recommend the use of other technical indicators to confirm the CMF's signals like Moving Averages, for example, especially in shorter time frames.

Some traders also like to draw additional lines onto the indicator at levels +0.5 and -0.5, narrowing the range to more significant regions:

It is also relevant to observe divergences like the price and the CMF moving in opposite directions or the indicator showing weakness. These may be indications of a trend reversal or a pullback.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!