Indicators provide additional information to direct market observation. This combined data, usually obtained directly from exchanges, make a relevant contribution to the decision-making process.

Analysts Tushar Chande and Stanley Kroll realized that they could go beyond price and volume manipulation, combining different techniques to improve results, they created the Stochastic RSI (or StochRSI).

Adding it to your platform

To add it to your desktop, right-click the chart, select Add Indicator and type Stochastic RSI:

Note

The authors appreciated signals provided by oscillators such as RSI. But, for many assets, overbought and oversold limits were rarely reached, which reduced trading opportunities.

Intending to increase RSI sensitivity without modifying the interval (smaller intervals tend to generate greater volatility), they added stochastic characteristics to the RSI.

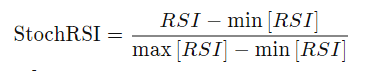

Here is the calculation formula:

The Stochastic RSI measures the gap between the highest (max[RSI]) and lowest (min[RSI]) indicator readings in a chosen interval. The result is an oscillator ranging from 0 to 1 that produces more buy and sell signals than the original Relative Strength Index.

Interpretation

Reading the Stochastic RSI is quite simple:

- Sell: The asset is overbought when it’s above 0.8, the indicator signals bearish vulnerability. A sell signal is generated at the crossing of 0.8 from top to bottom.

- Buy: The asset is oversold when it’s below 0.2, the indicator signals bullish vulnerability. A buy signal is generated at the crossing of 0.2 from bottom to top.

Note

The Stochastic RSI generates more signals than the original RSI. We can think of the indicator as a high-speed RSI. However, more signals usually mean less accuracy. Having more trading opportunities has the disadvantage of having to add more confirmation techniques to your analysis.

Many users of this indicator tend to add the study of patterns and other indicators that monitor data beyond price to the analysis process, like the OBV, which also uses volume readings. With some precautions, you can take advantage of the Stochastic RSI’s greater sensitivity to develop more accurate trading systems.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!