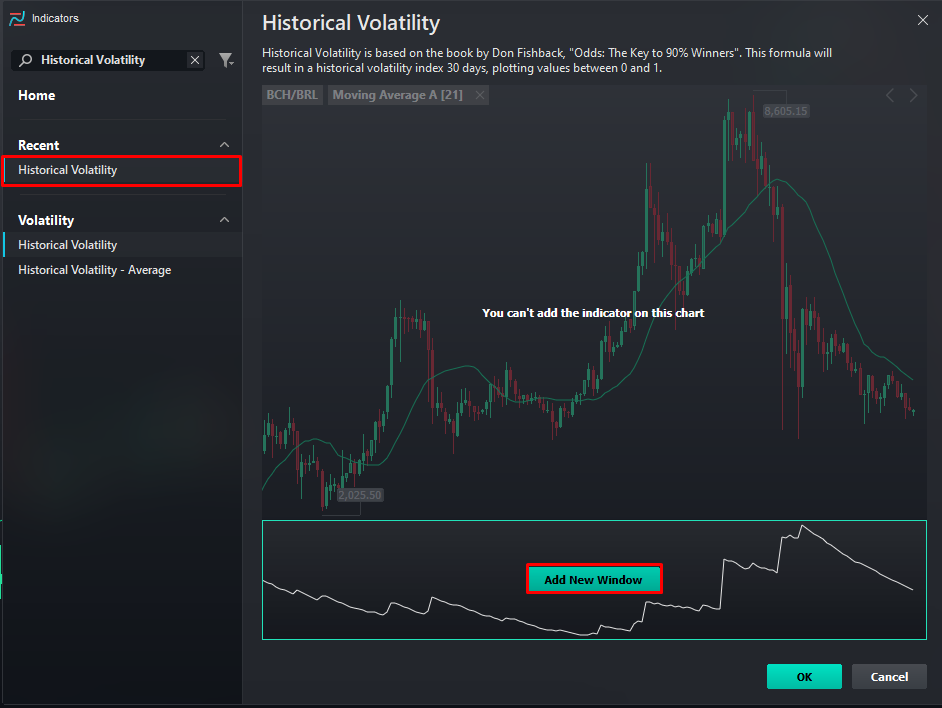

The Historical Volatility indicator shows the volatility range of an asset in numerical data.

This indicator is widely used to show potential placing for Stop Loss and Gain Orders.

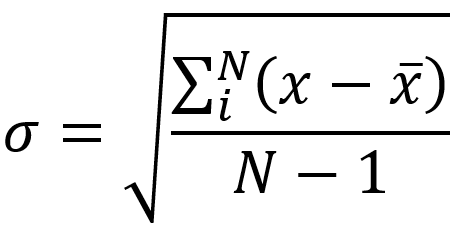

Calculation method

The Historical Volatility indicator is calculated as a percentage of the standard deviation of the periods, multiplied by the square root of the chosen range of periods. The annual period is equivalent to 252 periods, and the monthly period is equivalent to 21 periods.

TP/SL Orders Placement

It is important to emphasize that the Vector Company does not recommend any type of operating parameter. Our intention is only to instruct users on the use of the indicator. We will use a generic value example, not a recommendation. Please consider parameters according to the strategy you might adopt.

For positioning TP/SL Orders, we must grant a target percentage of the Moving Average. For this example, we will use 15% of the Moving Average, indicated by the green line. The average marks 77.22%. So, the TP/SL target will be 77.22 * 0.15 = 11.583%.

The current price is R$183,000.55. So, for a buy order, the TP/SL Orders are, respectively, R$204,197.50 and R$161,803.60.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!