The Force Index uses price and volume to identify possible reversal points through abrupt price movements or divergences. The author Alexander Elder developed this technical indicator, and it was featured for the first time in his classic book Trading for a Living.

To add it, right-click the chart, select Add Indicator and type Force Index.

Formula

Its formula uses the price range between two periods (according to time frame) and measures the size of the movement and its power:

Force Index = Current close price - Previous close price x Current volume

The Force index's values will be positive or negative depending on whether the current closing price was higher or lower than the previous. When multiplied by the current volume, it will determine the significance of the movement.

The data is then used to form an Exponential Moving Average instead of a histogram applied to other oscillators.

Exhaustion

A trend is exhausted, or too weak to continue moving in the same direction, when the price has risen or fallen too far and one side, bidders or sellers, lost interest. This event can be identified in a few different ways, one of them is by using the Force Index.

On the chart below, the Force Index peaks higher than usual, suggesting the trend is fading. The price started to correct the following day:

Divergences

As with other oscillators, look for divergences between the Force Index and the price. It is recommended the use of broader periods for this, like [13] or [22]. When the indicator fails to follow the price chart, making similar higher tops or lower bottoms, we can expect a possible trend reversal.

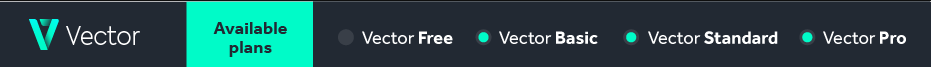

There are no fixed rules for its parameters, and investors have to find their ideal setup. To personalize, right-click the indicator and access its Properties:

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!