Many traders who use graphical indicators choose technical analysis to identify trends and certain entry and exit points for trades. Among the various indicators available, there is the oscillators category - so called because they use moving averages to add value to the decision-making process and oscillate around an axis. Some of the best known indicators in this category are MACD, Price Oscillator and Stochastic RSI. In this article we will cover the principles and workings of the oscillator indicator Trix and its derivative TrixM.

Trix

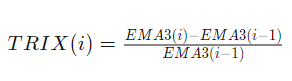

Created in the 1980s by Jack Hutson, who at the time was editor of the Technical Analysis of Stocks and Commodities magazine, the Trix indicator smoothes out false signals of price changes, as occurs with simple moving averages. In order for that to happen, three exponential moving averages are performed over a number N of intervals, which explains the origin of the name triple exponential average. Finally, the percentage difference between the values of the N and N-1 averages is performed, resulting in the indicator value. In summary, the following steps are:

- EMA1 (exponential moving average) of N intervals over the asset’s closing price.

- EMA2 over the values of EMA1 for N intervals.

- EMA3 over EMA2 for N intervals.

- Percentage price difference between N and N-1 using EMA3.

This calculation’s result is a triple average that is less susceptible to sudden price fluctuations, showing market trends more clearly and facilitating decision-making. However, the indicator should not be used by itself in an analysis but a tool to aggregate in the technical analysis of a certain asset.

And how can I put it to use?

The first most common use is as a trend moment when crossing the indicator’s 0 line.

Simply put, positive Trix values will indicate buy, and negative values will indicate sell. In the example below, we’ve inserted a resistance line in the indicator window to highlight the 0 line. The cryptoasset in question is BTC, with a 5-minute periodicity.

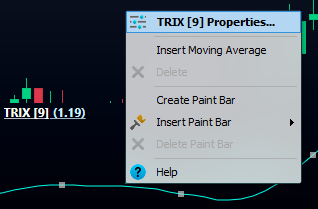

The second way of using it is with a short exponential moving average, called a signal. In this case, when the indicator crosses the average upwards, it would be a moment of buying, and when crossing it downwards, it would be an indication for selling. Although this second way is quite popular, it tends to indicate more wrong signals in the analysis.

In the example below, we’re using a red 9-interval exponential moving average signal next to the 15-interval Trix indicator on ETH/USD with a 60-minute periodicity.

TrixM

It is a variation of the Trix indicator itself, being a variation rate in relation to the previous candle. In other words, the TrixM value will be the difference between the Trix value for the current and the previous candle.

It helps to realize the intensity of the indicator movements. In the example below, the 11 o’clock candle has a Trix value of 0.12 and 0.01 TrixM.

And what does it mean? Between the current and the previous candle, there’s been a variation of 0,11 in the indicator’s result, that is, we can deduce that the 10 o’clock’s candle value of Trix is 0,11.

The calculation could also be considered in the following formula: TrixM = Trix - Trix[1]

TrixM = 0,12 - 0,01

TrixM = 0,11

This way, TrixM will show how the Trix value is varying. Values closer to zero will indicate smoother variations, while values farther away are a sign of sharp variations in the indicator. Added to Trix's own analysis, both can bring important signs of market trends and reversals.

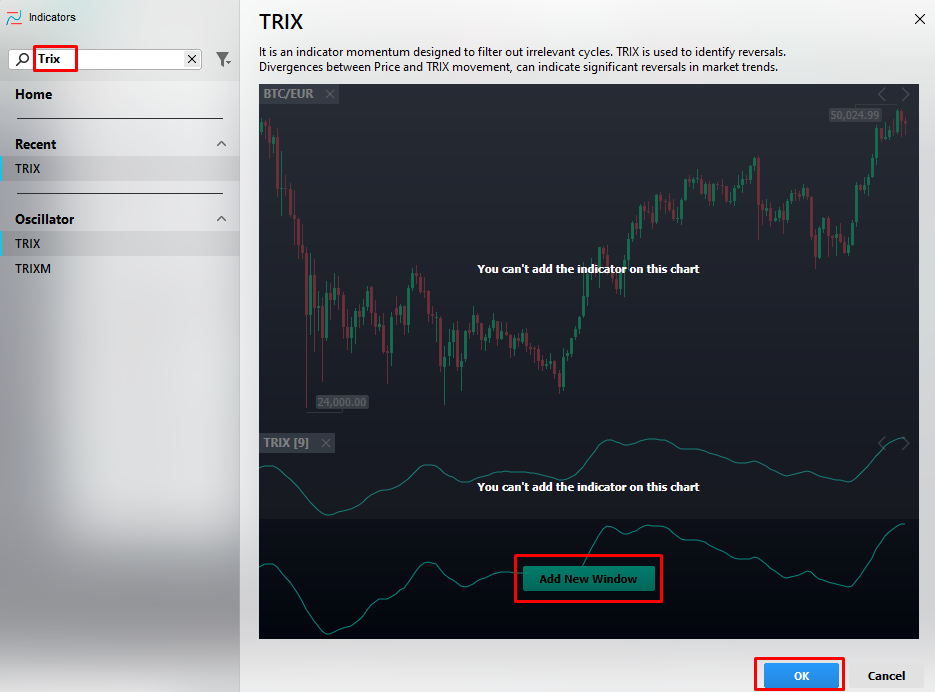

How do I add it to Vector?

Right-click the chart > click on Add Indicador. Both indicators will be in the Oscillator subgroup, but you can also search directly for Trix:

The properties, such as number of intervals and type of average, can be altered by right-clicking the indicator’s name once it has been added to the chart. It’s also possible to insert an internal moving average in case you wish to use it as a signal.

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!