In the cryptocurrency market, exchanges are in charge of defining their own trading rules. They all have independent oscillation, volatility, and quotes. So, we can commonly observe differences in the rules each exchange applies to every pair.

For example, BTC/BRL can have its lot size set to BRL 0,01 at one exchange, while another exchange establishes a size of BRL 0,0001 for the same pair.

We can also find vast differences in lot size depending on the exchange we choose. Using the same pair as an example, exchange A might establish a minimum order size of BTC 0,001, while exchange B uses BTC 0,0001 as the lot size.

There are many exchanges actively participating in the cryptocurrency market and directly affecting the value of assets they individually offer. For this reason, it is paramount to know all of their rules and specific instructions for each pair we choose to trade.

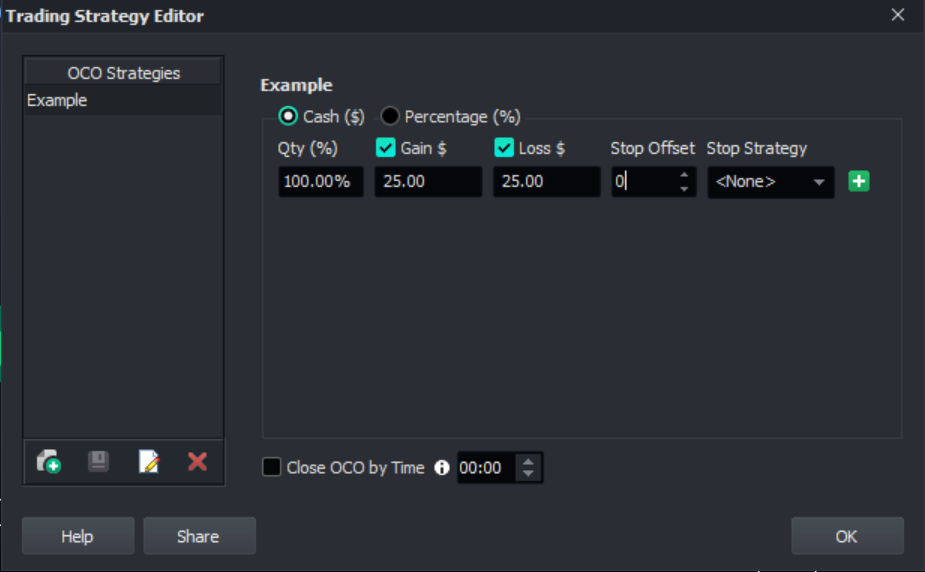

Size rules can also affect OCO order strategies since the distance is one of the parameters we need to define for gain and loss orders:

Find out more about the trading rules of our partner exchanges below:

Binance: https://www.binance.com/en/trade-rule

Binance US: https://www.binance.us/en/trade-limits

Coinbase Pro: https://www.coinbase.com/legal/trading_rules

Mercado Bitcoin (Brazilian Portuguese): https://www.mercadobitcoin.com.br/comissoes-prazos-limites

NovaDAX (Brazilian Portuguese): https://www.novadax.com.br/tradingrules

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!