Limit Orders

Limit orders are market offers; the buying and selling intentions of market participants.

Investors often place limit orders at the market without knowing what they are. Which at first, may seem that the order was not executed at the requested price.

Their main characteristic is the fact that they compose the Order Book (Menu Tools > Market Depth).

When a limit order is sent, it joins the book and its execution queue. The queue considers the order of arrival so, whenever you send the limit order, it goes last on the execution queue.

Buy limit order: always sent below current market price.

Sell limit order: always sent above current market price.

Stop Orders

Unlike limit orders, stop orders are not listed on the Order Book. So they don't join the execution queue.

The stop order will only join the Order book's queue when the market reaches its price. It will be executed according to offers availability.

Buy stop orders: always sent above current market price.

Sell Stop Orders: always sent below current market price.

These orders have a trigger price, called Stop Price or just Stop, which is the price defined by the user, and also a margin for execution (which can be the same value), indicating up to which price level the order can be executed.

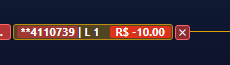

When sending orders through chart or SuperDOM, Vector will inform the type of order sent, as shown below:

Stop Order

Limited Order

Hey! Was this content helpful?

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!