A Trailing Stop is an advanced risk management strategy featured only on the Pro version of the Vector platform.

Set automatic adjustments to a Stop Loss order with a Trailing Stop, increasing the chances of positive results. A Trailing Stop protects gains by keeping the trade open, readjusting the order as prices move favorably.

How to set up a Trailing Stop:

Before defining a Trailing Stop, set up an OCO order (One-Cancels-the-Other Order) on the TP/SL Order Editor.

To learn more about OCO Orders read this article in our Help Centre, or watch a video tutorial (content in Brazilian Portuguese) from our partner Nelogica’s YouTube channel.

There are two ways to access the Trailing Stop Order Editor:

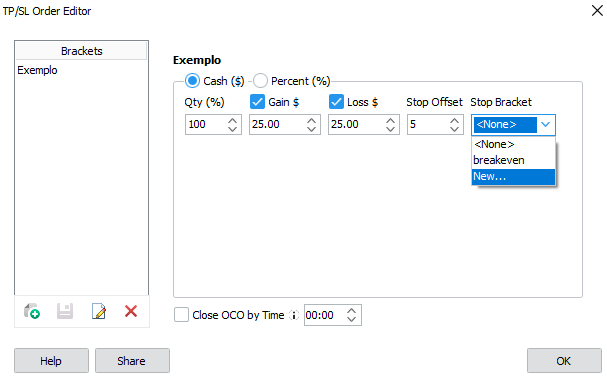

1. With an OCO Order already in place, access the Trade menu > Settings > TP/SL Order Editor, click on the “Stop Bracket” drop-down menu, and select “New”:

2. Or, access the Trade menu > Trailing Stop Order Editor.

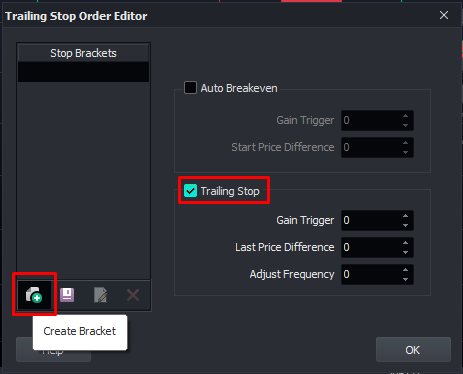

On the Trailing Stop Order Editor click on “Create Bracket”, name the setup, and select “Trailing Stop”:

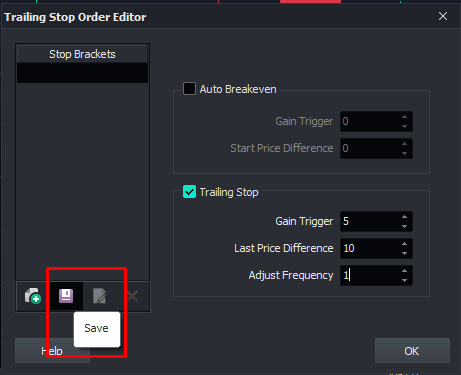

Now, let´s define the Trailing Stop parameters: Gain Trigger; Last Price Difference and Adjust Frequency.

Gain Trigger

This setting activates the Trailing Stop.

Last Price Difference

It's the distance between the Stop Order and the current market price.

When the Gain Trigger is activated, the setting “Last Price Difference” will make its first adjustment.

Adjust Frequency

This setting determines how far the market must move before the Stop order starts to follow after the first trigger.

To save your settings, click on the floppy disk icon.

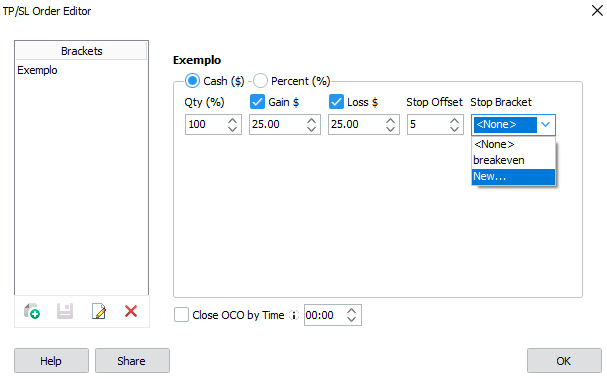

On the TP/SL Order Editor, select the Trailing Stop settings you have saved and add them to the OCO Order.

There you go! Now your OCO Order is all set up with a Trailing Stop.

Please rate it below! It's important that we work together to make our Help Center even more complete.

Happy trading!